Investor relations rational Exuberance

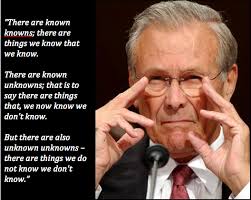

Professional soothsayers employ a type of parlor trickery. Financial jargon is a great mechanism for A/B testing.

So then, I will say in absolutely certain terms that:

We are in a bubble. Or. Not.

The most exculpatory evidence is the everywhere-ness of doublethink and the persuasion of its linguistic architects. Undisciplined reasoners cooperate and will one day plead Stockholm syndrome.

Nonsensical disclaimer: I think the markets go higher. Crowdfunding has dis-intermediated the boiler rooms that pitched penny stocks and capital is still buying growth. There is no reason that assets cannot be priced higher.

And the nonsensical disclaimer has this caveat; the markets go higher until they don’t. First they will churn and then plummet; alternatively they might plummet then churn.

Maybe the tech stock of today will have some parallels to the biotech’s stocks of the 80’s. Maybe they will fail efficacy tests, or clinical trials, or run out of funding, or regulators will impact their environment or investors will lose patience. Maybe they will be acquired for a fraction of the capital they have burned thru and supplement the research pipeline of the pharmaceutical giants.

Or maybe this time is different and the blackjack table will lose every hand to every spot on every night and the owners of the casino will be permitted to print their legal tender and that currency will retain its value.

Maybe pod people are being hatched and imprinted to endlessly consume and prices don’t matter.

And this other caveat to my disclaimer: The markets may go lower until they don’t. First they will continue to rise, then have small dips and spook people, then go higher, then small dips and spook people, then rise again.

I hope this answers your question

12Dec

Investor relations rational exuberance