Key points

The key issue is and always was the (lack of) resilience of the UK banking system.

It is mathematically impossible to take a weak banking system, subject it to stress and come up with a resilient banking system.

The BoE stress tests are worse than useless because they offer false risk confidence, like a cancer test that cannot detect cancer.

The biggest risk facing the UK banking system is the Bank of England’s complacency about it.

The results of the next set of BoE bank stress tests are due to be released tomorrow morning.

The key issue, as always, will be the BoE’s attempt to portray a resilience that isn’t there.

These stress tests work as follows. We start off with the banking system at the start of 2017. The BoE then puts the banking system through a couple of hypothetical stress scenarios and focuses on the stressed capital ratios at the peak of the stress at the end of 2018. These are to be compared to the relevant pass standard: a bank passes the test if the stressed capital ratio is at least as high as the pass standard.

So we have the capital ratios, the stress scenarios and the pass standards.

The BoE will focus on the capital ratios that look most impressive, portray the stress scenarios as severe and keep the pass standard as low as it thinks it can get away with.

Think of the stress tests as a parlour a game that the Bank likes to play. The Bank has to persuade us that the banking system is strong. Whether it is or not is another matter and doesn’t matter. The Bank plays the role of Tommy Cooper and has a number of tricks up its sleeve or wherever. Our (analysts’) role is to catch them out. It’s great fun.

Capital ratios

The BoE’s favourite capital ratio is the ‘CET1 ratio’, the ratio of Common Equity Tier 1 (CET1) capital to Risk-Weighted Assets (RWAs). However, results based on this ratio are not the worth paper they are written on, because the RWA measure is highly unreliable (because it is highly gameable and makes no sense anyway), and the BoE’s own chief economist Andy Haldane has discredited it.

This leaves us with a class of capital ratios known as leverage ratios. A leverage ratio is the ratio of core capital to the total amount at risk. The BoE will want to maximise this ratio by selecting the highest numerator and the smallest denominator.

Numerator: Basel III postulates two measures of core capital, Tier 1 capital and Core Equity Tier 1 capital. Tier 1 is larger than CET1 because it includes Additional Tier 1, e.g., Contingent Convertible bonds or CoCos. However, CoCos are unreliable as core capital so the leverage ratio should always be measured using the narrower/smaller CET1 measure. The BoE prefers to use Tier 1 because that boosts the reported leverage ratio, but the BoE has no valid reason to use the Tier 1 measure instead of the CET1 one.

Denominator: Traditionally, the leverage ratio (or capital-to-assets ratio, as it was called) used Total Assets (TA) as the denominator. However, Basel III introduced a new denominator known as the Leverage Exposure (LE), which was meant to take account of some of the off-balance-sheet risks that the TA left out. Curiously, for most UK banks, the reported LE is less than the reported TA. Go figure.

In the last year or so, the BoE has also come up with a new trick. In the face of lobbying from the banks, the BoE has authorised a new LE – let’s call it LE BoE – that consists of the old LE minus banks’ deposits with the central bank. So we now have the old LE measure, as per Basel, and the new smaller LE UK measure.

There is also the distinction between book-value and market-value. Most financial economists would suggest that market-value is more informative, especially when market values are less than book. The ratio of market to book values is the Price-to-Book (P2B) ratio, and the average P2B across the big 5 banks is about 67%. The most obvious interpretation of such a low P2B ratio is that the banks are carrying losses that are not reflected in their accounts (a red flag!). An alternative explanation is that markets expect the banks to make low profits in the future, i.e., so their business models are questionable. But either way there is a systemic concern and the BoE is in denial.

Sir John Vickers and I have been arguing for some time that the BoE should pay more attention to market-values and, at the very least, report market-value-based results in its stress tests. The BoE refuses to do so, perhaps because doing so would make for less impressive headline results.

Note that to argue that market values are more informative than book values is not to say that market values are in any sense ‘perfect’ or to buy into a strong form of the Efficient Markets Hypothesis.

Market values also provided a better indicator of looming financial distress than book values did ten years or so ago.

The stress scenarios

The risk management literature recommends that stress testers should use multiple sets of scenarios for a simple reason: if there are too few scenarios, then there is a danger some material risk will be overlooked. We definitely don’t want that.

Traditionally, the BoE uses just one main macroeconomic scenario. This year, it will use two.

The pass standard

In the past, the pass standard for the Tier 1/LE was 3%.

As a general rule, the pass standard should be no less than the minimum required leverage ratio (otherwise the exercise makes no sense). This 3% comes from the Basel III capital rules, which impose a minimum required (Tier 1/LE) leverage ratio of 3%. Since Basel III also specifies that at least 75% of Tier 1 capital should be CET1 capital, this 3% leverage ratio translates into a minimum CET1/LE ratio of 2.25%.

More recently, the BoE introduced a second minimum required leverage ratio: the ratio of Tier 1 to TA should be at least 3.25%. I would describe this second leverage ratio requirements as long overdue baby steps in the right direction.

How high should the leverage ratio be? Well, in his book The End of Alchemy, Mervyn King suggest that a ratio of core capital to TA of 10% would “be a good start”. Many economists suggest a minimum of at least 15% and maybe more: see, e.g., this famous FT letter by Anat Admati and 19 other distinguished financial economists.

In short, the current pass standards/minimum required leverage ratios are nowhere near high enough.

UK banks’ current leverage ratios

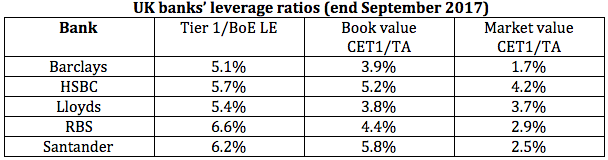

The table below gives some key leverage ratios for the biggest five UK banks.

Take Barclays. Using Tier 1/UK LE as the leverage ratio – one suspects that this will be the one that the BoE will be pushing – the leverage ratio is 5.1%. But if we replace Tier 1 with CET1 and replace LE with TA, then the leverage ratio falls to 3.9%. Then apply the market-value adjustment and the leverage ratio falls to 1.7%. One can read off the leverage ratios for the other banks in a similar manner.

The (unweighted) market-value average CET1/TA leverage ratio across the banks is 3%, a nice round number.

A loss of 3% would wipe out their capital.

I would suggest that these leverage ratios do not paint a picture of financial resilience that any reasonable person would recognise as such – and this is the current situation before any stress is applied.

The Bank’s challenge is to take this set of already weak banks, seriously stress them and then demonstrate their post-stress resilience. Good luck on that.

IFRS 9

On January 1st 2018, the new accounting standard IFRS 9 comes into force to replace IAS 39. IFSR 9 is intended to remedy some of the flaws in IAS 39 associated with the latter’s incurred loss model, by which losses are not recognised until incurred. Were IFRS 9 implemented as originally proposed, banks would have to report losses expected over the next 12 months and the banks would take a capital ‘hit’ as the new regime came into force. It is a matter of consider public interest to know how large that ‘hit’ might be.

For more on these concerns, see my October 3rd letter to Alex Brazier. This letter requested that the BoE report stress test results based on fully loaded IFRS 9, i.e., IFRS 9 when fully phased in. Since Mr. Brazier did not offer any such reassurance, one can expect the BoE to fudge this issue and it will be interesting to see how they do it.

General issues with stress tests

All regulatory stress tests suffer from generic problems:

1. The most basic is a lack of credibility. Even if the BoE genuinely believed that the UK banking system was in poor shape, they could not possibly admit to it, in part because they have an obligation to promote confidence in the banking system, and in part because such an admission would imply that the BoE had failed to fix the system, despite their repeated promises that they had done so. So when the BoE reassures us that the banking system had successfully passed the stress tests, well, they would say that, wouldn’t they?

2. The stress tests fail to identify important risks facing the UK economy. The IMF and the BIS have been warning about these for years. The stress tests are worse than useless because they give false risk comfort, a bit like the comfort of a cancer test that does not detect cancer.

Stress tests are just superstitious implements with a veneer of financial rocket science. Financial rocket science isn’t reliable either. Remember the Global Financial Crisis? Relying on this stuff is like using chicken entrails to warn of earthquakes, the difference being that sometimes the chicken entrails get it right.

3. The track record of regulatory stress tests is an appalling one. Regulatory stress tests told us that the Icelandic, Irish, Cypriot and Greek banking systems were sound. Whole banking systems, not just individual banks. Each failed not long afterwards and the stress tests failed to warn us. False risk comfort.

These problems are sufficiently serious that the only way to fix the stress test programme is to scrap it. But how would we be able to assess the state of the banking system, you might ask? Answer: by getting the accounting standards right. Gimmicks like stress tests don’t help.

The biggest risk facing the UK banking system now is, thus, the Bank of England’s own complacency.

Highlights from last year’s stress tests

We should keep in mind some of the highlights from last year’s stress tests and one suspects that similar issues might arise this time round as well.

What was striking last year was the number of errors of fact made by the BoE, both in its November 30th press conference and in the later January 11th 2017 TREASCOM meeting, when BoE witnesses were caught unaware by a story on News at Ten the previous evening. I detailed these in No Stress III last September.

Let me give Governor’s Carney’s remarks at that press conference as an example:

The resilience of the system during the past year in part reflects the consistent build-up of capital resources by banks since the global financial crisis. … the UK banking system is well placed to provide credit to households and businesses during periods of severe stress. […]

That conclusion is corroborated by the 2016 stress test [which is] broad, coherent and severe …”[…]

[The adverse stress scenario led to] system-wide losses of £44 billion over the first two years of the stress – five times those incurred by the same banks over the two years at the height of the financial crisis. (My italics)

This is nonsense. 44 ÷ 5 = 8.8 so Governor Carney seems to be suggesting that the losses from the peak years of the GFC were under £9 billion. However £9 billion is small beer and if he is right, then what was all that GFC fuss about?

In any case, Carney’s £44 billion ÷5 = £ 98.4 billion back in 2011, which he has since suggested might be an understatement. His estimate was a cautious one, but the number itself is alarming and is in any case much greater than Carney’s £8.8 billon.

James Ferguson of the MacroStrategy Partnership suggested a year ago that the cost might be £450 billion.

For some time I thought that Mr. Ferguson’s number was right but I am now wondering whether his number is high enough.

What made me think again is this chart from a recent speech by Martin Taylor, a member of the Bank of England’s Financial Policy Committee:

This chart reports losses of over £350 billion (and I emphasise billion not million) by early January 2009. Goodness, if the losses were over £350 billion then, one must wonder what they must be now. The honest answer is that I do not know, but in any case, one can say fairly confidently that these losses are likely to be more than the £8.8 billion suggested by Dr. Carney.

If the BoE cannot get such critical points right, then its credibility is shot and that is surely the central message.