for the full posts and archives

Those who have pushed the risk down the wealth-power pyramid are confident the Federal Reserve will continue to limit the risks of speculative financialization.

Longtime correspondent Chad D. and I recently exchanged emails exploring how the higher debt loads and higher interest payments of financialization inhibits people at the bottom of the wealth-power pyramid (i.e. debt-serfs) from taking risks such as starting a small business.One of the most pernicious consequences of financialization is the shifting of risk from the top of the wealth-power pyramid to the bottom: those who benefit the most from financialization’s leveraged, speculative credit bubbles protect themselves from losses while those at the bottom of the pyramid (the bottom 99.5%) face the full fury of financialization’s formidable risk.

But this is only one serving of financialization’s toxic banquet of risk-related consequences. Chad summarized how those at the apex of the wealth-power pyramid protect themselves from risk and losses.

At the top levels of the pyramid, members in those groups collect way more interest than they pay out and at the very top, they get a ton of interest and pay little to none. The people at the top can take all sorts of risk, because of this dynamic and further, they also usually have a heavy influence on the financial/political machinery, so they get bailed out by taxpayers when their investments go bad. In addition, because their influence extends to the criminal justice system, they are able to commit fraud and at the same time neutralize regulators and prosecutors, thereby escaping any ramifications from their excessive risk taking and in many cases massive fraud.

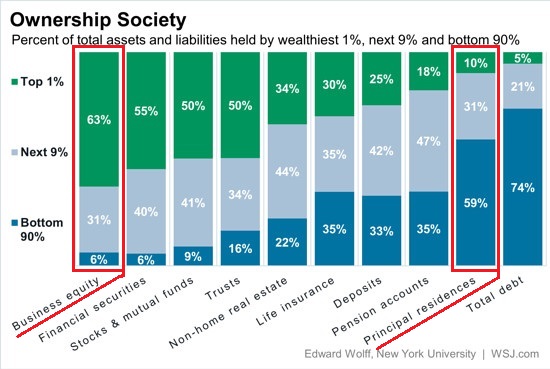

As Chad observed, the wealthy own the income streams from debt (bonds, etc.), while everyone else owes the interest and principal due on debt. As this chart shows, the wealthy own business equity and financial securities and have a modest slice of debt. The bottom 90% owe most of the debt, and their primary asset is the family home– an asset that doesn’t generate income while it generates interest income for those who own the mortgage. In other words, it’s less an investment than a form of consumption– especially when the current housing bubble deflates.

The asymmetry of risk and exposure to loss resulting from financialization is about to become consequential. Financialization has reached the top of the S-curve and is now in the decline phase. As noted on this graph, what worked so effortlessly in the boost phase of financialization not only no longer works, it actively boosts the risks of sudden, catastrophic losses.

Those who have pushed the risk down the wealth-power pyramid are confident the Federal Reserve will continue to limit the risks of speculative financialization. The S-curve is a pattern of Nature. If you’re confident the Fed is now the ultimate power in the Universe, then you’re betting that the Fed and Treasury will always absorb all the risk and all the losses, with zero consequences.

The S-Curve suggests that bet isn’t as low-risk as those at the top of the wealth-power pyramid currently believe.