Amazon is relentless. That is admirable, until it’s not. A bridge gets crossed and the relentless troops storm the other side, which, as it happens, we are all on. Beware that Amazon is a country, Jeff Bezos is its tyrant and we are the useful idiots

Tyrannies always turn inwards, Caesars will come home to roost.

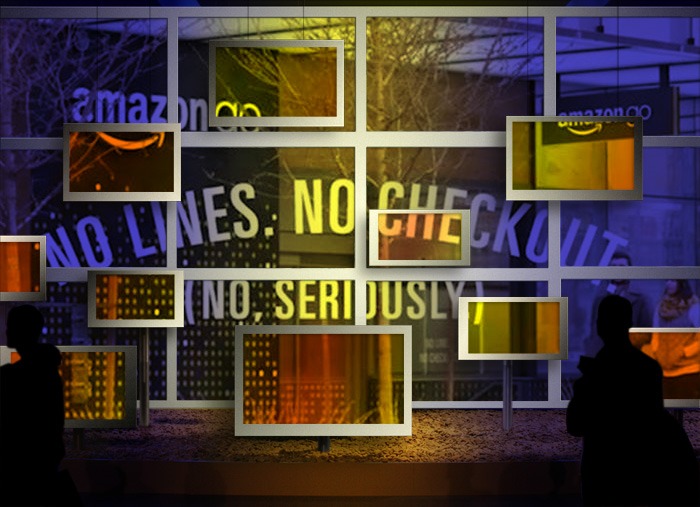

Looking thru the binoculars at the advancing army, its silhouette in the mist

Amazon revenues rank #1 Among online/Internet companies, generating $136b in annual revenues. They have 34% of Internet/online economy market share. They are the dominant online retailer, with $86.8b, which is 65% more than the next nine top U.S. online retailers combined

Workforce: Amazon employs almost 150,000 workers, and WholeFoods will increase that count by 91,000 and is currently number one with 49% of all Internet/online economy jobs

(click thru for what I wrote about the social burdens being forced off of Amazon’s balance sheets and unto ‘ours and the serious societal concerns for these soon to be not-employed workers and a list of demands)

Full-time, part-time, and temporary employees on Amazon’s payroll in the U.S. = 145,800

Displaced jobs at brick-and-mortar stores -294, 574

Net job losses at the end of 2015 -148,774

Food supplies: Amazon is number one with 22% share of the U.S. online grocery market

Platform Amazon increasingly controls what products make it to market and appear before us as we’re browsing. It has the power to pick winners and losers (Go to link for my review of the Amazon Bookstore) Amazon leverages the interplay between the direct retail and platform sides of its business to maximize its dominance over suppliers. As it extracts more fees from them, it’s hollowing out their companies and reducing their ability to invent and develop new products. Amazon’s dominance is already reducing their ability to invent and launch new products. As a consumer, how would you even know that something was missing?

By operating as both a direct retailer and a platform for competing sellers, Amazon can toggle back and forth, leveraging the interplay between these two parts of its business to maximize its market power. Everything you buy, starting with your weekly groceries, will be flowing through one pipe called Amazon

Logistical Support As Amazon grows its logistics empire, it’s also manufacturing more of the goods that are moving through it. They have unveiled 7 of its own fashion lines, offering more than 1,800 items

of apparel. It’s added hundreds of new products to its AmazonBasics brand, which now furnishes a wide range of household items, from computer cables to swivel chairs. On Amazon.com, many of these products rank as top sellers in their categories and show up first in search results. Amazon publishes books too, and it’s not uncommon for as many as half of the titles on its Kindle bestseller list to be its own

Finances… Between 2010 and 2016 Amazon’s net sales exploded from $34.2 billion to $136 billion. But its pre-tax margin, which was already thin at 4.4% in 2016 clocked-in at just 2.9% in the year just completed

On sales growth of $102 billion, Amazon posted only $2.5 billion of pre-tax profit gain. Indeed, apart from its cloud business (AWS) Amazon is essentially not a profit-making institution at all. Amazon has managed to avoid its share of taxes and tax collection. They had a pre-tax income of $3,512 million but paid only $152 million in taxes for an effective tax rate of 4.33%, The IRS is currently suing for 1.5 billion in unpaid taxes and in the EU, regulators are challenging the legalistics of certain tax structures in Luxembourg and elsewhere

…and the taxpayer Since 2005 Amazon has received approximately $900 million worth of subsidies to construct and operate its facilities, with $241 million awarded since the start of 2015, a staggering sum considering these facilities, regardless of any potential subsidies, had to be built The Postal Service is also subsidizing Amazon package delivery with first-class mail. If costs were fairly allocated, on average parcels would cost $1.46 more to deliver. Two-thirds of Amazon’s domestic deliveries are made by the Postal Service (I have written several posts doing the forensics on Amazon earnings. here and here

Propaganda Counter arguments and inquisitions of Amazon has been evaporated. Amazon, aligned with other technology un-employers have crafted a well marketed, PR/propaganda campaign that tells the world that the Robots and Artificial Intelligence usurpation of humans is inevitable. Critics are dismissed as #LudditesWhoOpposeTechnology.

Bezos has levered Universal Basic Income as a political tool to ease societal scorn for the increasing use of robotics.

And he’s charitable: The day before he announced his company’s attempt to buy this supermarket chain, he released a request on Twitter to have people offer ideas for where he can direct charity money. That is the kind of public relations undertaken by political leaders.

That PR/propaganda narrative is being amplified by journalists following the tech and finance industries who self evaluate as an avatar of economic progress and embrace Amazon’s framing of a heroic battle against backwards industries.

The resistance: Political opposition. Monopoly, Monopsony? Lets call the whole thing off

The cold war has started. U.S. Rep Cicilline has asked for hearings. Now we need you…

The antitrust concerns come from the market power that Amazon wields online, combined with the under-appreciated conflict in its business model where half of its retail revenues come directly from consumer-customers, and the other half of its retail revenues come from its MarketPlace offering where Amazon is the mall and gatekeeper for around 15 of its top 20 grocery competitor-customers, that have had to capitulate to Amazon’s market power and operate on Amazon Marketplace in order to reach all their offline customers online. The problem Amazon’s retail intermediary model causes competitors is that it simultaneously is a direct retail competitor overall, at the same time it is the dominant online broker that has disintermediated its competitors from their customers when they are in the online world, and in that broker role, they are routinely criticized as not being an “honest broker” or as being a “non-neutral platform,” that routinely self-deals anti-competitively, because Amazon has market power to extract it with impunity, and no antitrust or regulatory accountability to speak of – to prevent it

This would make Amazon Prime the tie that binds Amazon’s online and offline market power.

And it should be stopped. Now

27Jul

When the Amazon tyranny turns inwards. The resistance