Can worthless things circulate and be accepted in trade? If so, how? And can this state of affairs continue indefinitely?

The origin story of bitcoin is an expression of an antistatist ideology ‘tyrant free’ and ‘non-state money’. This was essential not only for Bitcoin’s initial value, but also for its survival. All media of exchange need a non-monetary value component otherwise their future purchasing power is indeterminate.

An intrinsically useless, unbacked, and costless fiat object might be accepted in trade, but only if it already has a positive price. A history of positive prices will generate sufficient expectations among potential acceptors that they will be able to trade that object on tomorrow.

But how did this bit of fiat earn a positive price to begin with?

If early adopters expected it to be widely accepted by others in trade, how did these early adopters ever form these expectations if that object didn’t already have a positive price?

We’re dealing with a problem of circularity. There is no way to “break into” a dynamic that might generate a positive value for a fiat object. Worthless things cannot trade in the market at a positive value.

However, fiat objects like dollars and yen do seem to have a positive value. Two economic schools solve the circularity problem in different ways:

Austrians say that when early adopters first acquired the fiat object, it was not yet intrinsically useless, unbacked, or costless. Thanks to its original commodity nature, or perhaps its status as a backed financial asset, it already traded at a positive price. Even if that character is lost, the object suddenly becoming a fiat one, it may still be widely accepted in trade on the basis of people’s memory of its pre-fiat price. Thus the circle can be broken into, and worthless bits of paper can legitimately have a positive value in trade.

MMT‘ers solution is another direction. As long as some agency like the government imposes an obligation on people to pay taxes with these fiat objects, that will be enough to drive their positive value.

Argue’ists might say ‘but the Fed…‘ But I don’t think we have a circularity problem with modern central banknotes since they aren’t worthless bits of paper but rather exist as a liability of their issuer.

What if the bitcoin rise was manipulated, a modern day penny stock pitched in a modern day boiler room?

The earliest, high volume bitcoin transfers were done within a tight circle of only a small group of ‘exchangers’.

If they all knew each other, and that those trades were more-or-less fictitious, with large values being traded and then traded back again, with the intent of enhancing the prominence of the positive-value equilibrium by drawing attention away from the much larger set of inactive Bitcoin markets. Bitcoin’s inventors were making highly visible leaps onto their own bandwagon, so as to encourage others to do so, whether to ideologically express themselves or to profit by doing so. In that way bitcoin was marketed, substitute for history by putting a positive sign on the expected value of an otherwise useless potential exchange medium.

When did outsiders begin to accept it in trade based on the expectation that others will repurchase it from them later? Well, my sister just bought her first smartphone this year. Last night she asked me ‘what is bitcoin?’

There are many mechanisms for ‘moving something up’ in the stock market’s lesser places, here’s only a few…

Wash trading. An individual or group of schemers trade an illiquid, often worthless, stock back and forth among different accounts. The goal is to give the illusion of activity, thereby attracting innocent retail (mom and pop types) who would otherwise pass up the stock.

High close. A trader or group of traders will buy a stock in the closing seconds of the day, pushing its price up. This is media friendly as they usually report only a stock’s daily closing price, also stock charts depend on the daily close, high closing may be a cost effective strategy for traders to create and benefit from the positive price momentum that news of a high closing price engenders.

Confederates. Work in conjunction with a seller to provide fictitious bids so as to drive the price higher than it would otherwise be worth.

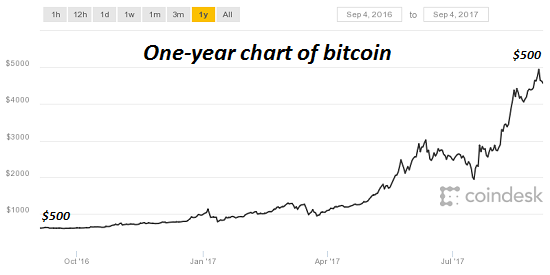

From nothing humble beginnings, bitcoin was pulled itself up by its own bootstraps.

If it’s price were to go to $0, there’s no guarantee of re-bootstrapping bitcoin back to some positive price. As such, Bitcoin users justifiably expect incredible returns from bitcoin holdings in order to bear the risk of a zero-value equilibrium. Expected hyperdeflation is the carrot that must be proffered up for risky cryptocoins to be held. When those expectations of price appreciation aren’t met, a large crash in the current price (relative to its future expected price) is necessary in order to tempt the next crop of speculators to hold it again.

Good luck with that

16Jan

Bitcoin in the boiler room