Dan Thornton has an interesting essay, “The Limits of Monetary Policy: Why Interest Rates Don’t Matter.’’

Just why do we think that the Fed raising and lowering interest rates has a strong effect on output (or inflation)? Just why does the Fed control short-term interest rates rather than the money supply, or something else?

Dan’s essay is a nice quick tour through the history of this question. No, there is not that much logic and evidence behind this hallowed belief, and yes, people did not always take the power of interest rates for granted as they seem to do now. Dan’s historical tour is worth keeping in mind.

This question is especially relevant right now. We are unlikely to see big changes in interest rates going forward. And central banks are busy thinking of different things to control — the size of the balance sheet; treasury, MBS, corporate bond, and even stock purchases; use of regulatory tools to control lending. So we may be on the cusp of a fairly major change in thinking about what central banks do — what their primary tool is — and how that tool affects the economy.

As Dan points out,

it is a well-known and well-established fact that interest rates are not very important for investment, or for spending decisions generally.

Quoting Bernanke and Gertler

… empirical studies of supposedly “interest-sensitive” components of aggregate spending [fixed investment, housing, inventories, and consumer durables] have in fact had great difficulty in identifying a quantitatively important effect of the neoclassical cost- of-capital variable [interest rates].

But I see an alternative breaking out. Investment is strongly influenced by stock prices, by the risk premium in the cost of capital. The total cost of capital is risk premium plus risk free rate, and the risk premium varies much more than the risk free rate.

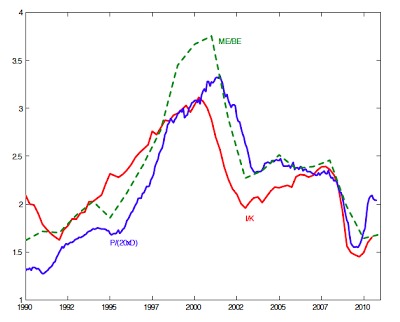

Here is the latest version of a graph I’ve made several times to emphasize this point. ME/BE is the market to book ratio of the stock market, or “Q.” P/(20xD) is the ratio of price to 20 x Dividends. IK is the ratio of investment to capital.

Investment responds to the stock market, and the stock market moves because risk premiums move, not because interest rates move.

The “alternative” then is the increasing amount of attention paid to the Fed’s effect on stock and corporate bond prices, together with evidence like this that investment responds to risk premiums in stock and corporate bond prices.

I am a long-time skeptic of the stories that say low levels of interest rates encourage asset price “bubbles”. But those stories are strong. So overall, what may break out is a story that the central bank can influence risk premiums (this needs segmented markets, leveraged intermediaries, and so forth — modern heirs to the “credit channel”) and risk premiums influence investment.

I recoil at the idea that central banks should start operating this way — targeting risky asset prices, using a range of tools to do it, and thereby affecting investment spending. But this may be where the world is going.

Now, back to Dan. After reminding us that consumption and investment spending does not respond (much) to interest rates, Dan’s intellectual history. (Excerpts here, the original is worth reading)

“So why do policymakers believe that monetary policy works through the interest rate channel and that monetary policy is powerful?” Well, there was one important event that brought economists and policymakers to this conclusion. Specifically, the Fed under Chairman Paul Volcker brought an end to the Great Inflation of the 1970s and early 1980s.

Prior to this event, Keynesian economists … believed that monetary policy was totally ineffective. “Why?” Keynesians believed that the only thing monetary policy could affect was interest rates. Since interest rates were not important for spending, the effect of monetary policy actions on interest would have essentially no effect on spending and, consequently, no important effect on output. Keynesians believed that monetary policy was essentially useless.

There was a smaller group of economists called monetarists who believed that monetary policy could have a large effect on output. But they believed this effect was due to the effect of monetary actions on the supply of money, not interest rates. Both Keynesians and monetarists believed that the effect through the interest rate channel would be tiny.

It’s worth remembering that the power of pure interest rate changes is a recent idea. Separately,

Bernanke and Blinder find that monetary policy works through the bank credit channel of monetary policy—not through interest rates. However, … because banks have financed most of their lending by borrowing funds from the public since the mid-1960s, it is unlikely that the bank credit channel is important. …It is now well-recognized that the bank credit channel of monetary policy is very weak.

I’m not sure Bernanke and Blinder (as well as other fans) agree with the last sentence, but the bank lending channel has always suffered the problem that 1) Fed actions have little effect on lending — as Dan mentions, reserve requirements really don’t bite 2) Only very small businesses really rely on bank lending. There are lots of them, but not much GDP.

So how did belief in the power of interest rates come about?

When he became chairman of the Fed, Paul Volcker made ending inflation the goal of policy. … He announced that he wanted to pursue a new approach to implementing monetary policy that “involves leaning more heavily on the [monetary] aggregates in the period immediately ahead.” …it seems to have worked. Inflation declined from its April 1980 peak of 14.5% to about 2.4% in July 1983….The policy change was also followed by back-to-back recessions…. the fact that the change in policy was followed by a marked reduction in both inflation and output led economists and policymakers to dramatically change their view about the power of monetary policy to effect output and inflation.

…economists debated whether the success of the Volcker’s monetary policy was due to a marked reduction in the supply of money or to higher interest rates. But the growth rate of M1 monetary aggregate changed little over the period. Moreover, the growth rate of M2 actually increased. In contrast, the federal funds rate, which was 11.6% the day the FOMC changed policy, increased to a peak of 17.6% on October 22, 1979. The funds rate then cycled, hitting cyclical peaks above 20% in late 1980 and mid-1981. Given the behavior of the M1 and M2 monetary aggregates and the behavior of the federal funds rate during the period, a consensus formed around the idea that the success of Volcker’s policy was attributable to high interest rates not to slow money growth.

Like the Phoenix, the idea that monetary policy worked through the interest rate channel rose from the ashes. … the FOMC adopted the federal funds rate as its policy instrument in the late 1980s, circa 1988. … Policymakers pay essentially no attention to monetary aggregates…

And academic analysis of monetary policy is focused entirely on interest rates. Dan doesn’t mention new-Keynesian models, but they epitomize the current thinking. The Fed sets interest rates, with no money at all, and higher interest rates induce people to spend less today and more tomrrow.

The problem is that nothing else changed. There have been no new studies showing that spending is much more sensitive to changes in interest rates than previously thought. … Bernanke and Gertler’s statement that monetary policy does not work through the interest channel is as true today as it was 20 year ago. What has changed is economists’ belief that monetary policy works through the interest rate channel. … economists’ and policymakers’ belief that monetary policy has strong effects on output through the interest rate channel is more akin to religion than to science. It is built on a belief that it seems to have worked once.

This belief is reinforced by fact that few economists believe that policy could work through any of the other possible channels of policy: the exchange rate channel, the wealth effect channel, the money supply channel, or the credit channel. Monetary policy seems to work, but it cannot work through any of these other channels. Conclusion: it must work through the interest rate channel.

Quoting Alan Greenspan

We ran into the situation, as you may remember, when the money supply, nonborrowed reserves, and various other non-interest-rate measures on which the Committee had focused had in turn fallen by the wayside. We were left with interest rates because we had no alternative. … – Alan Greenspan, FOMC Transcript, July 1-2, 1997, pp. 80-81.

What Dan does not mention, and I have above, is that central banks now do seem to have an alternative, and it’s pretty scary –well, to me at least. Controlling investment by controlling stock prices.