Imagine….

People are gathered at the beginning of time and formulate trading plans for a given vector of market prices (called out by some mysterious auctioneer)

Commodities can take the form of different goods, like apples and oranges. But they can also be made time-contingent and state-contingent. An apple delivered tomorrow is different commodity than an apple delivered today. An orange delivered tomorrow in the event of rain is different commodity than an orange delivered tomorrow in the event of sunshine

For any given vector of relative prices (there is no money), individuals offer to sell claims against the commodities they own to acquire claims against the commodities they wish to acquire.

A market-clearing price vector makes everyone’s desired trades consistent with each other

You got that? I’m asking you to imagine a pink elephant

So, we are imagining that all relevant trading activity takes place once-and-for-all at the beginning of time

Once trading positions are agreed to, all subsequent good and service flows across individuals over time and under different contingencies are dictated by the terms of promises made at the initial auction.

So, now that we’ve imagined the impossible, let’s suppose that…

you had earlier acquired the right for the delivery of oranges next month in the event of rain. Suppose it rains next month….

…Then the delivery of oranges is made by the orange producer who issued the promissory note now in my possession.

This is the perfect auction, no financial market frictions like asymmetric information, limited commitment, limited communications, and all those other things that can make an auction imperfect.

Meanwhile, in the real world. Financial institutions, governance structures in general and “the government” can be understood as collective arrangements that are designed to mitigate these frictions for the economic benefit of a given set of constituents, depending on the distribution of political power.

Onwards to the blockchain

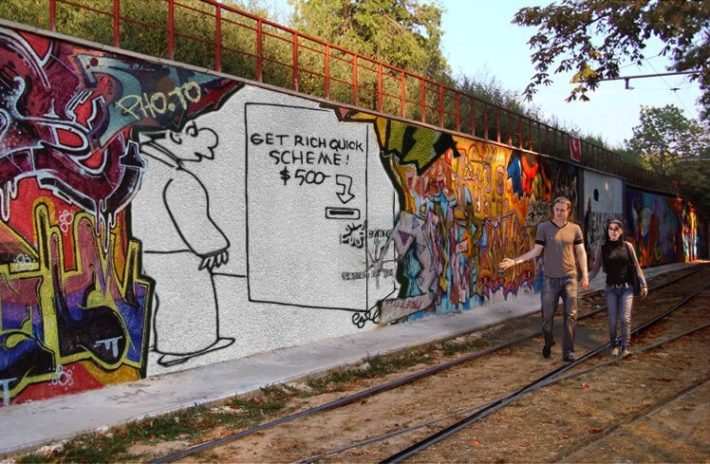

A recurring theme of the blockchain’ers movement is how this new record-keeping technology may one day permit us to decentralize all economic activity. No more (government) money. No more banks. No more intermediaries of any sort.

“Tokenization is the process of converting rights to an asset into a digital token on a blockchain” – Blockchainer’s mantra

Sounds fancy, but it’s not. It’s a variation of an old theme. It’s everything we were just imagining.

But, here is where I walk away from the blockchainer’s parade. One of the most frequently use cases is “How to liquidate a fraction of one’s illiquid wealth”

Let’s discuss amongst ourselves…

We use institutions called banks to monetize illiquid assets (banks transform illiquid assets into liquid deposit liabilities). But why do we need banks? Why are most assets illiquid? Economic theory answers…

Because of the frictions associated with asymmetric information and limited commitment (or lack of trust).

I have yet to read, see, or hear anything that precisely, without theatrics or exuberance, explains how the (fabled) blockchain solves any of the fundamental problems associated with transforming an illiquid asset into a payment instrument.

Blockchain is nothing more than a consensus-based database management system. Moreover, any useful innovation found in a blockchain-based database management system (recording data as a Merkle tree, for example) could likely be applied in a non-consensus-based database management system. It’s one thing to transfer tokens (or information) across accounts in a database. It’s quite another thing to exert your own effort to evict the non-compliant tenant of your 0.0005% share of the apartment you own, especially if other owners are not on board.

It may be that technology will one day eliminate financial market “frictions” and permit widespread asset tokenization (including our human capital), all of which will be traded using smart contracts on an Internet-based auction.

Or maybe not

h/t andolfatto

Imagine….

People are gathered at the beginning of time and formulate trading plans for a given vector of market prices (called out by some mysterious auctioneer)

Commodities can take the form of different goods, like apples and oranges. But they can also be made time-contingent and state-contingent. An apple delivered tomorrow is different commodity than an apple delivered today. An orange delivered tomorrow in the event of rain is different commodity than an orange delivered tomorrow in the event of sunshine

For any given vector of relative prices (there is no money), individuals offer to sell claims against the commodities they own to acquire claims against the commodities they wish to acquire.

A market-clearing price vector makes everyone’s desired trades consistent with each other

You got that? I’m asking you to imagine a pink elephant

So, we are imagining that all relevant trading activity takes place once-and-for-all at the beginning of time

Once trading positions are agreed to, all subsequent good and service flows across individuals over time and under different contingencies are dictated by the terms of promises made at the initial auction.

So, now that we’ve imagined the impossible, let’s suppose that…

you had earlier acquired the right for the delivery of oranges next month in the event of rain. Suppose it rains next month….

…Then the delivery of oranges is made by the orange producer who issued the promissory note now in my possession.

This is the perfect auction, no financial market frictions like asymmetric information, limited commitment, limited communications, and all those other things that can make an auction imperfect.

Meanwhile, in the real world. Financial institutions, governance structures in general and “the government” can be understood as collective arrangements that are designed to mitigate these frictions for the economic benefit of a given set of constituents, depending on the distribution of political power.

Onwards to the blockchain

A recurring theme of the blockchain’ers movement is how this new record-keeping technology may one day permit us to decentralize all economic activity. No more (government) money. No more banks. No more intermediaries of any sort.

“Tokenization is the process of converting rights to an asset into a digital token on a blockchain” – Blockchainer’s mantra

Sounds fancy, but it’s not. It’s a variation of an old theme. It’s everything we were just imagining.

But, here is where I walk away from the blockchainer’s parade. One of the most frequently use cases is “How to liquidate a fraction of one’s illiquid wealth”

We use institutions called banks to monetize illiquid assets (banks transform illiquid assets into liquid deposit liabilities). But why do we need banks? Why are most assets illiquid? Economic theory answers…

Because of the frictions associated with asymmetric information and limited commitment (or lack of trust).

I have yet to read, see, or hear anything that precisely, without theatrics or exuberance, explains how the (fabled) blockchain solves any of the fundamental problems associated with transforming an illiquid asset into a payment instrument.

Blockchain is nothing more than a consensus-based database management system. Moreover, any useful innovation found in a blockchain-based database management system (recording data as a Merkle tree, for example) could likely be applied in a non-consensus-based database management system. It’s one thing to transfer tokens (or information) across accounts in a database. It’s quite another thing to exert your own effort to evict the non-compliant tenant of your 0.0005% share of the apartment you own, especially if other owners are not on board.

It may be that technology will one day eliminate financial market “frictions” and permit widespread asset tokenization (including our human capital), all of which will be traded using smart contracts on an Internet-based auction.

Or maybe not

h/t andolfatto