Spoiler alert:

Zenefits was a sled.

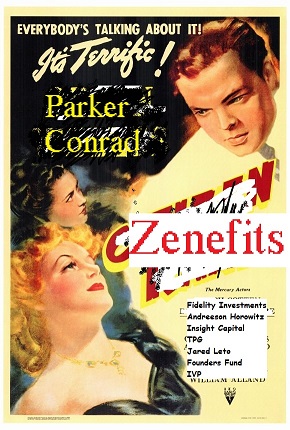

There is a cinematic quality to Zenefits. It would make a great movie franchise and can be re-booted for the next generation of filmgoers.

Camera pans to the remnants of a once opulent estate. Pan to empty pool with a old newspaper at its bottom. Pan to the library room of the mansion owner. He is unseen but we hear an exhausted voice say “Zenefits” and then pan to a snow globe shattering on the floor.

Story Boards:

1. Is Zenefits over?

Yes.

(context) The profile of the prospects and clients of the industry leaders such as (Insperity, Workday, Oracle, ADP, TriNet etc.,) are ‘first time’ users. The leaders are staffed with a high ratio of service, marketing, credit, sales. Cost of client acquisition is high but recovered quickly in margin. Lifetime value of a client is enormous, attrition is low. Leaders have an all in solution and the operational excellence to extract value from looks.

(more context) The prospect and client profile of Zenefits are former clients of the industry leaders. These clients understand the benefits of outsourcing the administration, insurance procurement, compliance and risk transfer. They have gone thru years of renewals and now are experienced enough to consider the (much) lower priced alternatives.

(where we are now) Zenefits is scratched off the ‘vendors to evaluate’ spreadsheetSelecting Zenefits is all risk, no gain. For Zenefits to recover from all the tactical mistakes, low employee morale, client migration and headlines is generational and requires an underlying profitable business rather than something that (ahem) is not.

2. How did this happen?

Elaine: Did you read the whole thing?

Kramer: Oh! yeah.

Elaine: Huh . So What’s it about?

Kramer: Well it’s a story about love, deception, greed, lust and…unbridled enthusiasm.

Elaine: unbridled enthusiasm…?

Kramer: Well , that’s what led to Billy Mumphrey’s downfall.

Elaine: Oh! boy.

Kramer: You see Elaine, Billy was a simple country boy. You might say a cockeyed optimist, who got himself mixed up in the high stakes game of world diplomacy and international intrigue.

No great movie like Citizen Zenefits Kane has ever been made without the extraordinary talents of great actors and all those wonderful geniuses on the other side of the lens

a. Investors like to annoint a winner before the market has.

b. Mega funds need to invest more dollars then there are deals to invest in.

c. Venture Capital Valuation Inflation. (VCVI)

d. Windows are open to liquidity events and public and private markets have a large and undiscerning appetite.

(The journalist investigating Citizen Zenefits Kane turns to the camera. He is an English dandy type and is dressed like Oscar Wilde)

He wanted to build an empire. He wheeled his masive Trojan Horse into the city gates but he had no concealed soldiers inside, his horse was empty. The enemy took his horse and beat him mercilessly. Oh dear me!

e. Andreeson Horowitz thought they solved step 2 of the underpants gnome guide to making millions. For them Zenefits was a SaaS company that had a golden goose (the insurance book of business) When you mix bluster, testesterone and alcohol, furniture will get broken.

f. TPG. Baffling investment. Very smrt people. They know the space and had some very big winners. Maybe they thought it would make a good home for Insperity if the shareholder actions got more heated.

g. Fidelity has a bad track record in this category, they tried to build a retirement benefits pipeline 15 years ago with a company called HR Tech that was a huge failure.

h. David Sacks. Wall street candy. Came in for the pivots and will leave for the divots®©

3. How does it impact HR tech companies?

The clone wars is almost over

There have been a lot of new entrants in the space that have re-framed competition from quality to price. The leaders and the best of the new entrants will benefit from capacity being taken out of the market and bodes well for a restoration of profitability and improved margins into 2016.

Venure Capitalists are excellent at pattern recognition and have very little pain tolerance. VC’s will accelerate on the off ramp rather then carry risk into next year.

The best of the HR companies can now distinguish themselves from Zenefits and their (relative to their industry) look-alike competitors.

The selection process of investing in HR Tech becomes more disciplined. Big fractions of the money steered away from the risk of ‘unicorn failure’ will find a comfy home with companies that want to build a business.

Whats next?

On one side are those that have put their fingers on scales and wrapped low quality in high rated ‘unicorn’ paper.

On the other side is everbody else

INT. CELLAR – XANADU – NIGHT –

A large furnace, with an open door, dominates the scene. Two

laborers, with shovels, are shovelling things into the furnace.

Raymond is about ten feet away.

RAYMOND

Throw that junk in, too.

Camera travels to the pile that he has indicated. It is mostly bits of

broken packing cases, excelsior, etc. The sled is on top of the pile.

As camera comes close, it shows the faded rosebud Zenefits and,

though the letters are faded, unmistakably the word “ROSEBUD” Zenefits

across it. The laborer drops his shovel, takes the sled in his hand and

throws it into the furnace. The flames start to devour it.

No lights are to be seen. Smoke is coming from a chimney.