I am a fan of the Professional Services bundle. I also like services that are unbundled. Both can work well to create above average shareholder return.

This is what happens in-between pivots. It is a few of the Rumsfield unknowns.

We are now into approximately year 6 of a cycle of cash hunting growth. Somewhere in year 2, Professional Services companies took their turn at bat.

That vintage made it into the public markets. The next tranche is off the bench and are exhausting whatever currency they have to get top line growth while synthesizing acquisitions and focused on leverage and operational excellence. These are problems of a company far down a road. You can’t do a proper inventory until you have enough clients and years of look backs to do an analysis. Laws of large numbers is great when you have it, but its useless when its theoretical.

Now we are ankle deep into the third tranche. Recently funded, valuations a bit too high. Their challenge is to decide on their strategy early in their lifecycle:

1. Will there be an exit. Can it be reasonably forecast? 2. Can we build a company that can be operated profitably if there is no exit?

It’s an equivalent of obligating a child to commit to the job that they glibly showed interest in when asked the requisite question by an adult.

It’s the product of the short history of technology and the gluttony of the public markets. New entrants into a mature market are not given the time to mature their operations.

My theory: I believe that companies must expect to operate the machinery that they build.

The greatest problem is that the public markets will suffer SaaS indigestion:

If you re-couple SaaS to the historical stock market: A SaaS index has, give or take (but what’s a couple of billion between friends) about 200 billion in market cap, they are deep in the red on net income and skipping to the answer: a weighted aggregate P/FCF of +100 and an abysmal cash flow yield. How much will people pay for growth going forward? (Quick note that many companies are subscription model and can only report to subscriptions paid.

The great thing about the stock market is in the long run it is a perfect pricing mechanism.

Bundle or unbundle:

A bundle is (optimally) a legal monopoly of the type that movie studios were denied.

On the flip side monopolies are expensive to build and even more expensive to maintain. Challengers come from the periphery of the empire and will build small kingdoms on your soil.

Zenefits was a great business until it wasn’t.

They built a simple, kinda frictionless doorway for prospects to gain information, get a proposal, convert to clients and self onboard. They created a tremendous velocity of clients, low cost of acquistion.

Despotic governments can stand ‘moral force’ till the cows come home; what they fear is physical force.― George Orwell

Clients perceived the product as free or extremely low cost. Early adopters are great at suspending disbelief. The reality has hit home.

Insurance, arbitrage and residuals, their principal leverage deteriorated as the largest medical carrier networks increased their own margins, or got group information back after a year+ of history gave more certainty to pricing risk. Then came the headlines, regulatory battles and state involvement.

I think David Sacks will pivot the company, they have a lot of installed assets, client goodwill and patience but their attempt at a grand bundle funded by endless pockets is over.

Bundles built on top of someone else’s stack (insurance in this instance) doesn’t work anymore, pattern recognition can also be wrong, patterns change and you rarely recognize this in advance.

Their are just no more big books of high quality business to buy so growth has to be generated mostly by organic growth. The economics of buying clients vs organic acusition depends on your outlook of the market. If y9u can afford to dramatically overpay, you better be able to make sure clients stick, mechanisms to extract profit and the apparatus to do all this without tipping the apple cart

Companies rarely die of starvation, what kills them is indigestion.

Bruce Wayne: The bandit, in the forest in Burma, did you catch him?Alfred Pennyworth: Yes.Bruce Wayne: How?Alfred Pennyworth: We burned the forest down.

Bundled:

a. Top line is expensive; it’s all calculated backwards from the public company multiples. An undisciplined checkbook will cause major problems that will take another generation of management to resolve.

b. Buy: Complimentary companies on the cheap and can be operated as a factory,

c. Avoid logo hoarding. Don’t let motion be confused for progress.

d. If the expectation is cross pollinating amongst your clients be aware that process takes time and still requires lots of human intervention.

e. Companies with a bundled strategy typically acquire (and rationalize) divergent business acquisitions and underestimate the resource drain and disruption it will cause. Many times the minnow survive and eats the whale in small chunks from within.

f. Bundles can cause poor client selection and pricing.

Unbundled:

Chose one station along an assembly line, get it to optimum efficiency and then move sequentially to the next. Gear to one type of car and that can’t be retooled easily. Completely own one process.

Companies must do this (doh, a now acceptable scrabble word so you can play it confidently) but if you are building a company to survive an uncertain future you must plan to operate it rather than simply dress it. Buy cash, buy assets, and buy clients. Let them run autonomously. Don’t disrupt what already works.

This interferes with most Venture Capital needs; this is (another) reason why I encourage most entrepreneurs to decline VC money. It has a big cost at a far off point.

The Chechen: What do you propose?The Joker: It’s simple. We, uh, kill the Batman.[mobsters laugh]Salvatore Maroni: If it’s so simple, why haven’t you done it already?The Joker: If you’re good at something, never do it for free

Being a precision focused provider will allow a deeper penetration into the client. You are foregoing some client facing visibility, but the reality is that those appearances are too expensive right now, visibility is overpriced.

a. Intimacy. Being laser like focused on one complete process permits much greater client intimacy. This exposes an enormous vulnerability of the present incumbent or bundled market leader. Thos companies have had to alter staffing ratios to reduce client facing service and improve margins.

b. Client retention is more predictable. Most bundled providers have foregone a renewal specialist and instead try to either make it forever green and automatic or effortless. Clients are evaluating vendors yearly, if you have someone dedicated to emphasizing, reiterating the value there may be negotiation, but the client will stay. They want somebody to answer the phone when something goes wrong – and it will.

c. A bundle allows you to under price one service and overprice another. Clients will live with this arrangement as long as the net cost is in line and the convenience factor is high. But (and there is always a but isn’t there?) it makes you particular easy pickings to a new entrant that breaks the bundle and pricing mythology. Right now with over capacity in the market bundles are particularly exposed to new entrants with a modular approach. As the market starts taking capacity out, which it absolutely will, you should aim to then be bundled, having made strategic and accretive acquisitions. So it’s an issue of proper sequence.

d. A bundle will battle a market leader much quicker than an a niche entrant provider. The incumbent response is usually reducing their cost to combat than the new entrant and sales brute force. It becomes a war of attrition that they will win. Let the others battle it out and sneak in after both sides have exhausted themselves. Patience is a virtue, grandma was right.

Some big part of the decision is stylistic and also dependent upon the perceived quality of the competitors and their resources.

Rome, in its early days, did not win because of superior generals; they won because they had more land and therefore more available people to turn into soldiers. When their first line was killed in battle, they went back to the farms, recruited more soldiers, an endless cycle until their opponent was depleted.

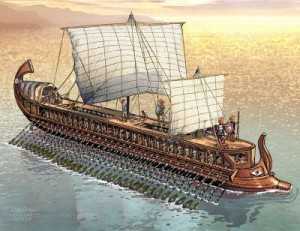

Another great example corrupted from history is the success, for a time, of the Hellenistic triremes in naval battles. They could come in, sink their opponents and then quickly turn around and get the heck out of there. There were greatly maneuverable. They beat war ships. That worked until it didn’t. Soon the Greeks required larger war boats, more soldiers to be moved, more wood, more people needed to propel and much more vulnerable.

What you are attacking you will become. What you defend you will one day attack.

Military history should not be neglected. it was the innovation of its time, It was the newest technology andi t was disruptive. The featured image is of a trireme, a remarkable creation. If you would like to learn more please visit: http://someinterestingfacts.net/greek-triremes-the-ultimate-fighting-machines/

Ben Richards: Killian! I’ll be back!

Damon Killian: Only in a rerun.

the running man

06Apr

Bundle Unbundled and back again