This post is only relevant to SaaS and professional services companies such as Recruiting, Staffing, Employee Management, Payroll, Learning Management, Applicant Tracking, and Accounting. etc.,

Please read the full warning and list of contraindications at end of post

SaaS is an acronym potion that affects everybody a little differently.

What it once meant doesn’t really matter anymore, but if you say SaaS to us, who are nostalgic and who were there, at that time and in those places, SaaS was a competitive differentiator and a business philosophy. And it was asset optimization and value creation along each link in a long chain.

In 2011, Mark Andreessen wrote an excellent essay published in the Wall Street Journal – Software is eating the world

That meal had been prepared years earlier and what he observed and commented on was the second course. Companies like Castlight Health, Zendesk, HubSpot that were following the examples of pioneers like Salesforce and TriNet and moving into other industries.

Today, at the end of 2015, software’s world consumption is on its fourth course. For the younger or less informed, or less nostalgic person, SaaS is no longer descriptive, it is just a vestige. For them everything is SaaS and always has been.

SaaS has become a plastic term and is now a set of characterisitcs and a topology.

The front line of the consumerization of the enterprise is an aggressive phalanx of Venture Funded SaaS new entrants. The most disadvantaged new entrants are new market, new product. They do not have the benefits of the legacies that preceded them. No marketing, education, evangelizing and dmeand generation was there before and that also means no ‘easy’ clients and prospects to convert. No 0 to 60.

The new entrants are on one side of a wall and the profitable market leaders are on the other. The difference between the two will not be resolved with time and patience. Those dynamics work only to the advantage of the market leaders as they are better prepared to endure a war of attrition.

There is one qualifier to get on the other side of the wall: Appetite for risk and all the processes and apparatus to acquire, arbitrage and price for it.

Venture capital has urged their SaaS companies away from risk.

VC has defined parameters for revenue that are geared to selling the story and a liquidity event. But, it is likely the markets have turned and there is no exit. They will have to operate what they built (the build a bear rule).

The portfolio companies that have achieved top line milestones are rewarded, or punished, with new capital and a higher valuation.

There are few, or no, levers to convert clients to profitability. To build or buy and then staff those levers moves the companies away from SaaS and into ‘service’ and also makes them look more like the market leaders they substituted.

New entrants have built a mousetrap to appeal to clients that are leaving the market leaders. Market leaders have built their mousetrap to appeal to new ‘non users’. Its an entirely different business model.

The substitute offering was diagrammed from the looks at the source object above the surface of the water but, the secret sauce happens below. And thats key. Most of the new entrant founders did not come from the specific industry, they had an idealized and mytholigcal perspective on what ‘it’ is. They pitched to a VC that also had only glimpses above the surface and maybe some anecdotes. The VC’s rely on the entrepreneur for precision and direction and the entrepreneur relies on the VC for that same precision and direction.

For the VC, unknown industry and an arguable client acqusition strategy is all the risk they are willing to hold overnight.

A stubborn object is meeting an irresistible force. SaaS and professional services companies have to create value and charge for it, there must be a restoration of profitability.

We are going into 2016 and things are changing. Public markets are suffering from SaaS indigestion. Without a likely exit into the public markets and in an environment in which the market leaders are less willing to make non accretive buys. SaaS companies need to operate profitably what they have built in a market with excess capacity.

Under the surface of the market leaders is their management of risk and adherence to pricing discipline and tight client selection.

A business must have residual income beyond one or two line items and/or subscription revenue. Some quick schema

Benefits procurement has shifted away from businesses courtesy of the Obama administration and the US taxpayer, so there was some risk to businesses of future cash flows and premium increases that has moved away. Benefits have been utilized as an appeal for attracting and retaining talent and that is a weakening levee. Employees will not leave because of medical/dental/supplemental benefits. But for a vendor, offering benefits as a broker and enrolling employees and contractors is a great business. It requires building or buying those factories. They are not cheap, they trade for multiples of future earnings. But it does tether the employee to the vendor. It means you can have portability and retained and forecastable earnings.

Compliance risk: Every jurisdiction and agency has found an easy prey hunting small business for violations in taxes, reporting, compliance. Prospects want to transfer that risk. Its not beautification and its not convenience, its not an app. Its contractual and its profitable if its underwritten correctly.

Ancillary products. I don’t like strategic relationships as distribution channels and to fill out an offering, that system is always flawed. It is a whack a mole of gains and losses. I believe for a provider to move from good to great requires building out dedicated services and capacity. The push and pull of smart phones has alleviated a good chunk of the human intervention that used to be needed to sell and service low margin ancillary businesses. Operate each as an autonomous factory. Don’t confuse the resource allocations or burden sales reps with to much too sell. Get looks at everything on the street, every business big and small. That lead then gets split up a million ways to all the ancillary products. With maturity, underwriting can manage the various buckets so that you have tremendous flexibility in pricing to net profitability.

It all starts with an appetite for risk. If you dont have risk recognition and an appetite, the risk still exists, it just isn’t being properly evaluated, mitigated and priced.

CONTACT YOUR FINANCIAL MANAGER IMMEDIATELY if you experience calf or leg pain, swelling, or tenderness; change in amount of urine produced; chest pain or heaviness; confusion; coughing up blood; fainting; irregular heartbeat; left-sided jaw, neck, shoulder, or arm pain; mental or mood changes (such as depression); numbness of an arm or leg; one-sided weakness; persistent, severe, or recurring headache or dizziness; severe stomach pain or tenderness; slurred speech; sudden severe vomiting; sudden shortness of breath; symptoms of liver problems (such as yellowing of the skin or eyes, fever, dark urine, pale stools, loss of appetite); unusual or severe bleeding; or vision changes (such as sudden vision loss, double vision)

09Nov

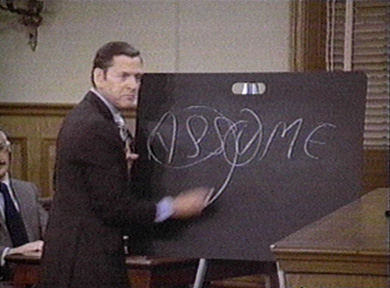

Don’t make a SaaS of you and me