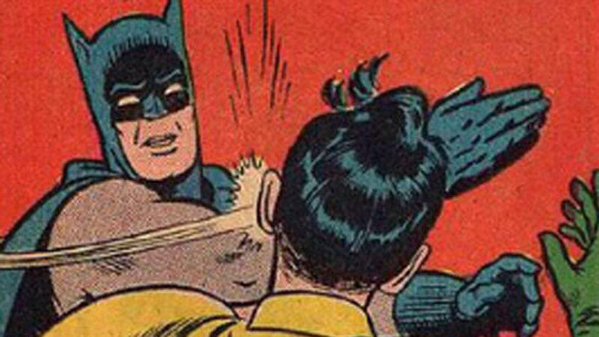

If you are a Venture Capitalist, the market has slapped you across the face. It is a duel.

The pain takes a while to work the long distance from dinosaur tail to dinosaur head, but there is an injury and it will be a pain that’s gonna linger.

Most VC’s I know are emotional beings that grab at the impulse items at the supermarket checkout.

They’re thinking that if something is cheaper today than it was yesterday, therefore it must be a better deal today than it was yesterday. That is wrong. ‘It’ had less risk yesterday becasue it was an object in motion and now it has stopped. This market has years of gains and exuberance to churn thru. This has been a huge flaw in the propulsion of VC rounds, ‘price to what the market will bear’. The inverse of that is truer.

Most VC’s have never endured a sustained down market. Prior to VC they were students or product managers that made good under someone’s else’s shingle, then moved on and became a VC. They don’t understand the illogical and irrationality of despair in a market, of people with no pain tolerance and little appetite for risk.

I have been an LP in many tier 1, secondary and tertiary Venture Capital firms. I wrote about my perspective and retreat into a family office and syndicate here: LP. Venture Capital hot water and creeping normality

Venture capital has shifted from being thematically managed to purely opportunistic. This leads to undisciplined behaviour and price wars for marquis portfolio names.

Venture Capitalists are not cynical. They are the trusting type new prisoner that accepts a stick of gum from the nice convict two cells down. This is, hopefully, self correcting. If a venture capitalist wants to have a career in Venture Capital they have to become Zen and learn to refuse the tempation of the gum chewed today and paid for tomorrow. There has to be at least one other partner in the firm who has the their money in the pot and who is the cautious one. They’re personality type must be the person who checks the bill at dinner for extra charges.

There is good news and there is bad news and the wonderful thing is that markets are impermanent. What was good will be bad, what was bad will be good.

History has shown that down markets are the best time to start a business and the biggest realized returns in VC were bets laid in down markets.

I am a buyer, but not yet…

The companies that survive this market will be eating what all the failed companies planted. The economy we are about to go into will take a lot of excess capacity out of the market.

This is good as profitability will finally be restored.

The race to the bottom is over (I hope). In the last few years competition has been reframed from quality to price. Now we should see it once again reframed and prices lifted.

The survivors will look to buy ancillary products that complement the primary offering but can also stand alone, they are factories, their own P&L, their own sales staff. Keep the companies operating autonomous of each other, this way it’s not too many divergent businesses under one umbrella. Salespeople have very little shelf space. Redundancy can be good as it can be reduced later. It will be another operational lever.

Lastly, but most importantly, you must have a flexible theory that can be put on a whiteboard.

This is choppy water and you can’t just loose a boat onto the sea. I have been pounding the table for months for people to become their own expert, read Krugman and Summers and a few others, i wrote a short list. Don’t rely on Fox Business or CNN, Business Insider or any other recycler. Please start here: Fed raise and capital. A short reading list…

It doesn’t have to be the way it is, you say it isJust because for the past twenty years, every day it is

Now I know, only I can stop the rain – DMX. The rain

“6” style=”load-more” items_per_page=”6″ button_color=”mulled_wine” item=”basicGrid_TextFirst” grid_id=”1452440132169-addfb752-6111-6″ taxonomies=”51, 141″]

16Jan

When the market slaps an unsure Venture Capitalist